The trading volume of new energy second-hand cars exceeded one million for the first time in 2024. However, many dealers remain cautious in the new energy second-hand car market.

In 2024, the used car market in China hit a new high. Data released by the China Automobile Circulation Association shows that the cumulative volume of used car transactions in 2024 reached 19.614 million units, an increase of 6.5% year-on-year, with a total transaction value of 13 billion yuan.

Unlike the market trend of being low at the beginning and high at the end in previous years, the used car market in 2024 showed a U-shaped trend. The first quarter of last year continued the market trend from the end of 2023, with transaction volumes expanding and a year-on-year increase of 7%. However, during the second and third quarters, the used car market experienced a bottoming-out process in sales due to the intense impact of price wars in the new car market, showing significant characteristics of a market off-season. In response to the "Several Measures on Strengthening Support for Large-scale Equipment Upgrades and Consumer Goods Replacement" jointly issued by the National Development and Reform Commission and the Ministry of Finance, various regions across the country began to introduce detailed subsidy rules for car replacement and updating policies starting in September 2024. Driven by these policies, the used car market also welcomed a peak in transactions, with a year-on-year increase of 9.7% in the fourth quarter.

"Driven by the subsidy policy for scrapping updates and the car trade-in policy, the demand for used cars has increased," Lu Guangzhi, deputy director of the Information Department of the China Automobile Circulation Association, told reporters. The age structure of used cars is gradually shifting towards lower age brackets, indicating that most consumers prefer models with shorter years of use when purchasing used cars. At the same time, consumers' concepts about used car consumption are gradually changing. In addition to focusing on price factors, they are increasingly paying attention to the cost-effectiveness and long-term use costs of vehicles, and they have higher requirements for vehicle performance and stability.

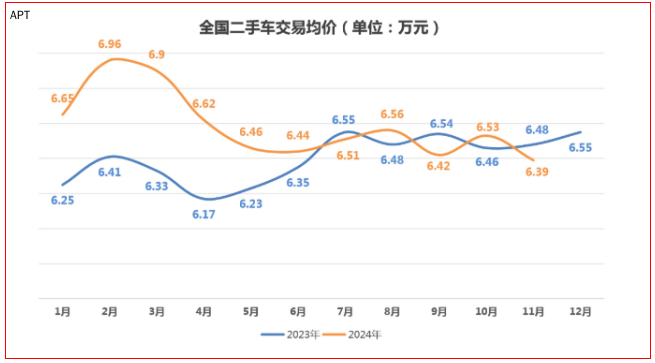

In recent years, the intense price competition in the automobile market has significantly impacted the used car market. Starting from the second half of 2022, price wars between fuel vehicles and new energy vehicles have been frequent, with substantial price drops in the products of multiple brands. This has led to situations where the prices of new cars are even lower than the purchase prices of used cars for certain models, making it difficult for used car dealers to profit and even resulting in losses to some extent. In 2024, the price war spread further, affecting a wider range of models, and the overall average price of used cars showed a downward trend. In February 2024, the national average price of used cars reached its peak at 69,600 yuan, which coincided with the lowest monthly transaction volume for the year, a 17.63% decrease compared to January. After February, the transaction prices of used cars began to decline, and after June, they started to stabilize, but still showed a downward trend. Overall, the trend of the average price of used cars after February 2024 closely resembled that of 2023.

"Looking back over the years, the turnover rate of used cars generally does not exceed one month. In the past two years, the inventory of used cars has been as high as 50 days in several months. Some models have been in stock for too long and have had to be sold at a discount. This is because once the inventory period is extended, the vehicles depreciate rapidly, and at the same time, they tie up capital, which also brings risks," Liu Zhi, a used car dealer who asked to remain anonymous, told reporters.

.jpg)

With the implementation of the trade-in policy in the third quarter of this year, the inventory of used cars has shortened, but overall, it remains at a high level. Taking November 2024 as an example, the average inventory cycle for used car dealers was 48 days. Lu Guangzhi stated that as the year-end approaches, dealers are increasing their efforts to clear inventory and adopting discount promotion measures to stimulate market vitality. At the same time, the continuous decline in new car prices has had a significant impact on transaction prices.

The China Automobile Circulation Association's report indicates that the price war in the new car market has caused the buying and selling prices of used cars to linger at low levels. In 2024, the gross profit margin per vehicle for used car dealers has generally declined. Among the top 100 used car dealers, 49 have a gross profit margin of 4%-6%, 29 have a margin below 4%, and only 4 have a gross profit margin above 10%.

"Some new cars, after a price reduction, are priced close to nearly new cars, and in some cases even lower than the price at which used car dealers buy them. In such situations, to sell them, further price cuts are necessary. In the past two years, many used car dealers have been operating at a loss," Liu Zhi told reporters.

It is noteworthy that the trading volume of used new energy vehicles exceeded one million for the first time in 2024. Lu Guangzhi stated that under the impetus of policies, continuous technological progress, and the increasing awareness of consumers, used new energy vehicles are expected to become a major highlight in the second-hand car market in the future. In particular, under the policy of trade-in for new vehicles, the consumption and replacement demand for new energy vehicles has increased, providing a vast space for development for the used new energy vehicle market. On the other hand, with the increase in the number of new energy vehicles, their evaluation and monitoring systems are also constantly improving, which has, to some extent, enhanced consumer trust in used new energy vehicles.

However, in the used car market for new energy vehicles, many dealers still maintain a cautious attitude, with only a few products like Tesla and Li Auto being relatively popular. On one hand, the resale value of new energy vehicles is still lower compared to fuel-powered cars. Data from the Guazi used car platform shows that new energy vehicles depreciate the most in the first year, and after three years, the depreciation is generally over 50%. About 10% of new energy vehicle models have a resale value of less than 50% in the first year, while the resale value of most fuel-powered models remains above 50% after three years. On the other hand, new energy vehicles have a fast iteration rate and greater price fluctuations, making it easier to incur losses after purchasing them. Moreover, some new energy vehicle manufacturers have unstable operations and are in a state of closure, causing the prices of their corresponding used vehicles to plummet.

The second-hand car auction and circulation service platform has released the "2025 China Second-hand Car Industry Outlook" by the joint research institution SG-Auto. The report indicates that by 2025, the prices of second-hand cars will continue to show a downward trend. Firstly, with a large domestic new car production capacity and under the stimulation of a series of policies, the number of vehicles in circulation will further increase, leading to a long-term decline in second-hand car prices. Secondly, the price war among new car manufacturers will persist, affecting second-hand car prices as well. With the linkage between new car sales and old car exchanges, the transaction volume of second-hand cars in China is expected to surpass the threshold of 20 million for the first time by 2025.